In this section :

1 – The different methods

Filing according to the agreed consideration

This is the standard method which is, from an IT point of view, the easiest to implement. Two methods of recording can be used: The “Gross” Method and the “Net” Method.

Gross recording method

Profit and Loss accounts (one for each VAT rate) record gross amounts, including tax, during the fiscal quarter. At the end of the fiscal year, owed VAT and deductible input tax are calculated based on the total amounts of those accounts. Therefore, VAT automation in MacCompta isn’t necessary as it used only once per quarter. The main downside of this method is that it doesn’t allow you (the accountant) to know the amounts owed to the AFC (Administration fédérale des contributions) during the quarter, which can have rather unpleasant surprises in store for you at the end of the fiscal year.

Net recording method

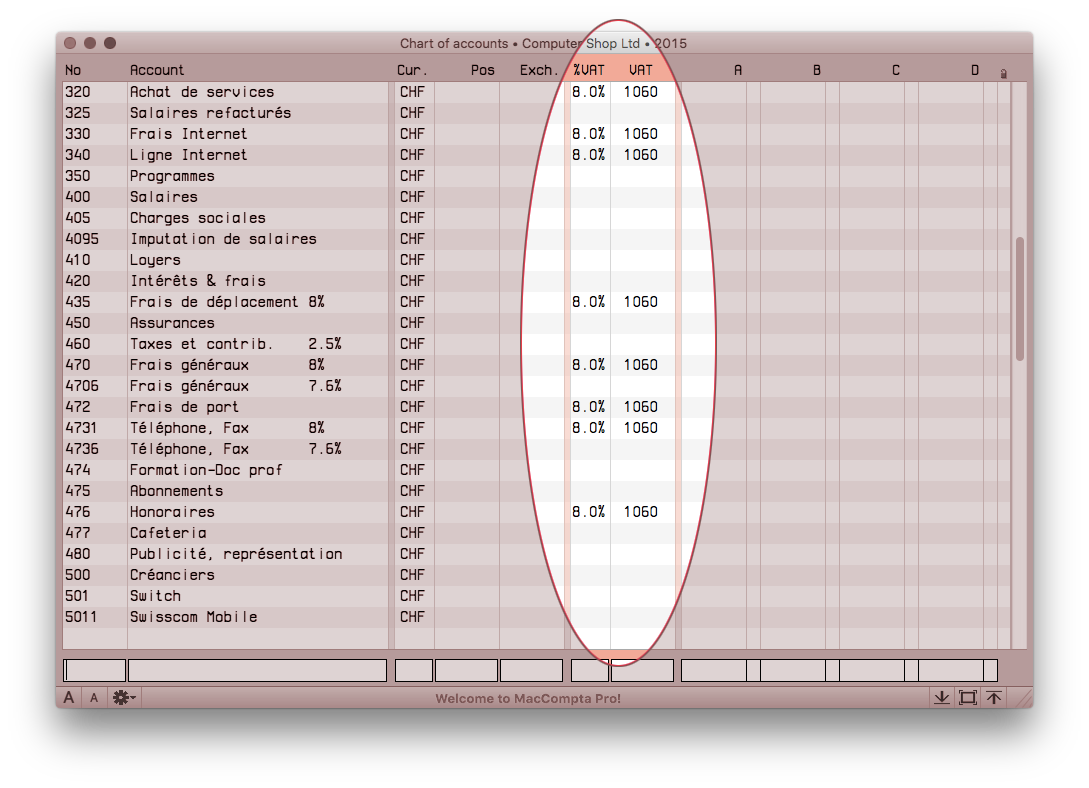

Profit and Loss accounts (one for each VAT rate if you want to be able to use VAT automation in MacCompta) record the net amounts (after deduction of the input tax), recorded on separate accounts, during the fiscal quarter.

“With this method profit and loss will always appear as net amounts in the accounts which allows for more clarity. Moreover, the “VAT” and “Input tax” accounts will indicate at any given time the exact balance of the account receivables or the tax liability towards AFC. “

(Article 890, Instructions à l’usage des assujettis TVA*)*Instructions for people subject to VAT

MacCompta therefore allows for each entry concerned with any account subject to VAT to automatically generate multi-legged transactions made of three lines with a breakdown of VAT or the deductible input tax.

“Mixed” VAT Recording

On the other hand, the calculation of the deductible input tax on investments and other operating expenses – for which a particular kind of breakdown must often be made – cannot be entirely automated. For such accounts, “gross” recording with deduction of the input tax at the end of the fiscal quarter has the advantage of allowing a qualified person to make these difficult calculations once every three months.

Filing according to consideration collected

This method, whereby VAT and the deductible input tax are only recorded after receiving some consideration or paying the bills, is not particularly difficult if the accounts are recorded according to the “système des postes ouverts”(art. 912, Instructions à l’usage des assujettis TVA). This means that you only record bills when they are paid or cashed. VAT and the deductible input tax are then recorded at the time of entering the transactions in MacCompta with VAT automation activated.

2 – VAT and the ledger

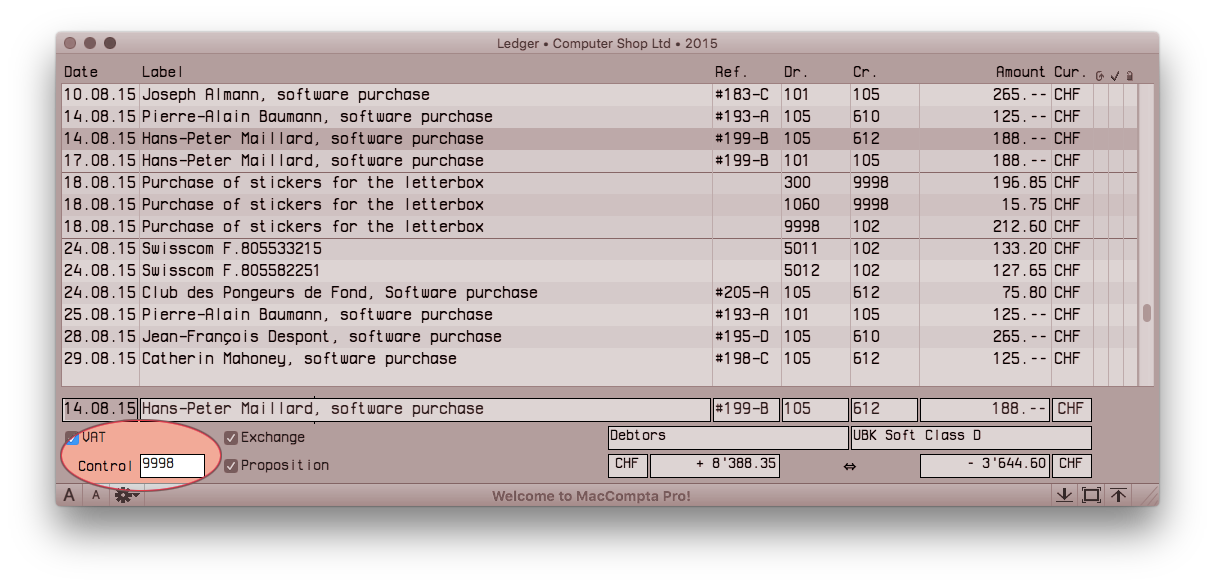

VAT box

Enable automatic calculation of VAT by checking the box.

“Control” accounts

Control account for VAT multiple transactions.

This account should remain the same all throughout the accounting period. If its number is changed, it may cause undesirable effects (negative control of transactions), notably at the time of importing subsequent transactions.

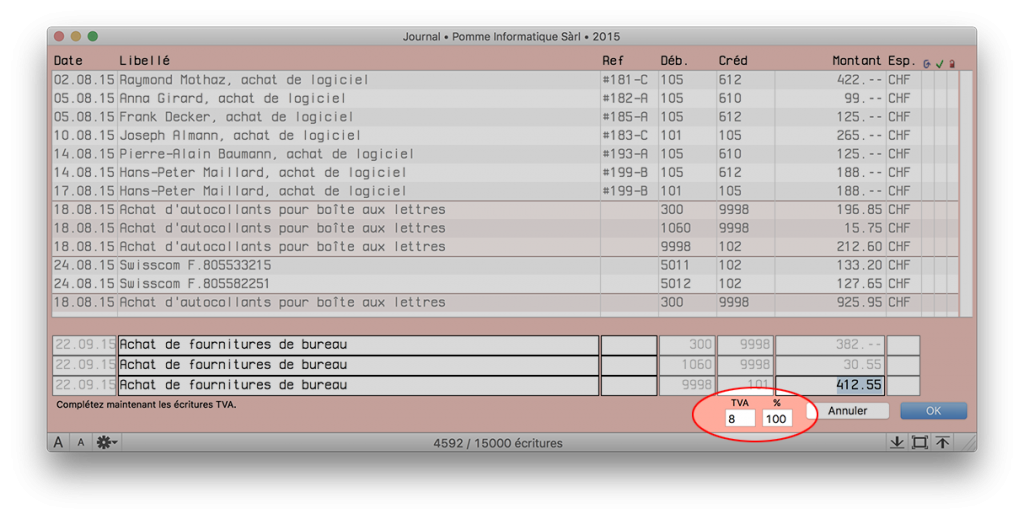

Choosing the VAT rate

It is not always possible to set a unique VAT rate which could be applied to all transactions in a given account and there are cases where VAT must only be applied to half the sum recorded or on 110% of its value (see “Instructions à l’usage des assujettis TVA”).

For accounts where VAT was set to zero, MacCompta makes it possible to calculate VAT based on a proposition where you’ll see the three lines necessary for the transaction, partially filled.

“VAT” field

VAT rate to apply

“%” field

Percentage of net amount (excl. tax) on which VAT must be calculated.

NOTE : To obtain an accurate calculation of VAT, the transaction in the ledger must always be entered using the gross amount (inclusive of VAT).

In the proposition, the net amount or the VAT part can also be modified.The calculation is made while taking into account the field in which we pressed the Return key to go to the next field.

Automatic closing & importing transactions

The check in the VAT box in the ledger must at all costs be removed when automatic closing takes place using the net recording method or you’ll risk incurring a second VAT deduction, which would be completely inappropriate.

The same applies to the importing of transactions on which VAT has already been calculated.

Tax liability net rate…

…for operations or companies whose turnover doesn’t exceed 500’000 CHF (art. 942, Instructions à l’usage des assujettis TVA)

VAT automation in MacCompta doesn’t apply to this kind of recording method. Such automation would make no sense anyway considering that VAT is recorded only once per fiscal year based on the overall sales turnover.

VAT and Foreign currency

All accounts subject to VAT or used to record VAT must be held in the main currency.

In any case, it is not possible to edit a transaction with an account subject to VAT together with an account in foreign currency in MacCompta.

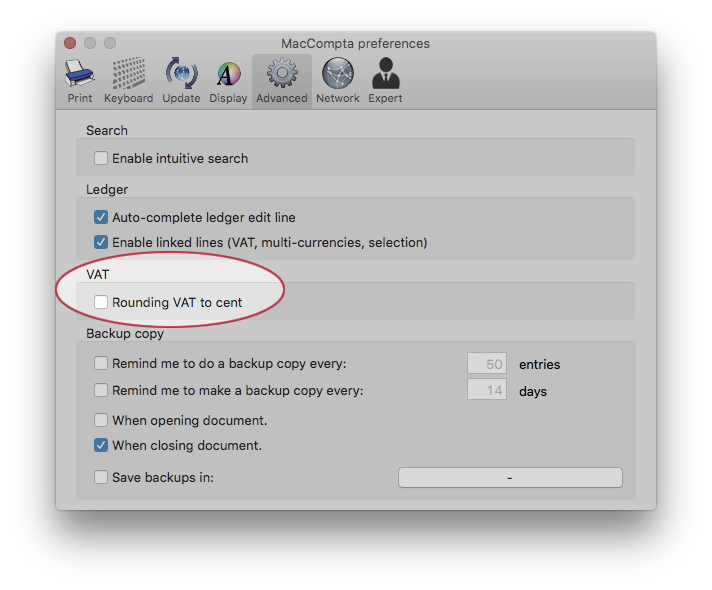

3 – Rounding up VAT

Before, VAT used to be rounded up by default to 5 cents. Now, you can choose whether you want to round it up to 5 cents or to 1 cent. This function can be set in MacCompta > Preferences.