In this section :

- Overview

- Currency chart

- Currencies and the chart of accounts

- Currencies and the ledger

- Exchange between two foreign currencies

1 – Overview

In MacCompta, you can account for transactions in foreign currency using the Currency-position and the Exchange accounts.

Two accounts in different currency cannot directly be balanced; it is therefore necessary to use two supplementary types of accounts : Exchange and Currency-position accounts for each foreign currency.

Let’s say you’ve got an invoice for 100’000 EUR with a Purchases account in CHF and an Accounts payable in EUR. The transaction cannot be entered as :

| DEbit | CrEdit | AMOUNt | CURRENCY |

|---|---|---|---|

| Purchases CHF |

Accounts payable EUR | ? | ? |

It will be recorded as :

| DEbit | CrEdit | AMOUnt | CURRENCY |

|---|---|---|---|

| Purchases CHF |

Exchange EUR | 112’470.– | CHF |

| Currency-position EUR | Accounts payable EUR | 100’000.– | EUR |

Each operation requires two transactions:

- One in the main currency (CHF) of which the Exchange account is the counterpart in the foreign currency (EUR).

- One in a foreign currency (EUR) of which the Currency-position account is the counterpart (EUR).

Likewise, when the debt is paid, you cannot record the transaction like this :

| DEbit | CrEdit | AMOUNT | CURRENCY |

|---|---|---|---|

| Accounts payable EUR | Bank CHF |

? | ? |

It will be recorded as :

| DEbit | CrEdit | AMOUNT | CURRENCY |

|---|---|---|---|

| Accounts payable EUR | Currency-position EUR | 100’000.– | EUR |

| Exchange EUR | Bank CHF |

112’328.30.– |

CHF |

Operations concerning two accounts held in the same currency only need one transaction. So, when a debt is paid using the credit of a bank account in EUR, you can record it as :

| DEbit | CrEdit | AMOUNT | CURRENCY |

|---|---|---|---|

| Accounts payable EUR | Bank EUR | 100’000.– | EUR |

The balance of the Currency-position account is equal to the sum of all the balances of accounts held in the same currency. At the end of the period, those balances are transferred one after the other at the official rate in a corresponding account in CHF. For example:

| DEbit | CrEdit | AMOUNT | CURRENCY |

|---|---|---|---|

| Accounts payable EUR | Currency-position EUR | 132’000.– | EUR |

| Exchange EUR | Accounts payable CHF |

158’970.– | CHF |

At the end of the accounting period, the balance of the Exchange account is transferred to Profit and Loss since it is a gain or loss on foreign currency transaction. For example:

| DEbit | CrEdit | AMOUNT | CURRENCY |

|---|---|---|---|

| Exchange EUR |

Gain/Loss on Exchange |

480.– | CHF |

If you made many purchases, you can open a “Purchases in EUR” account and transfer the balance at the spot exchange rate, say, once a month, in order to limit the number of entries, while making estimations about the volume of purchases at a rate which is very close to reality; this is done in order to perform a good commercial analysis.

Obviously, the same principle can be applied to sales.

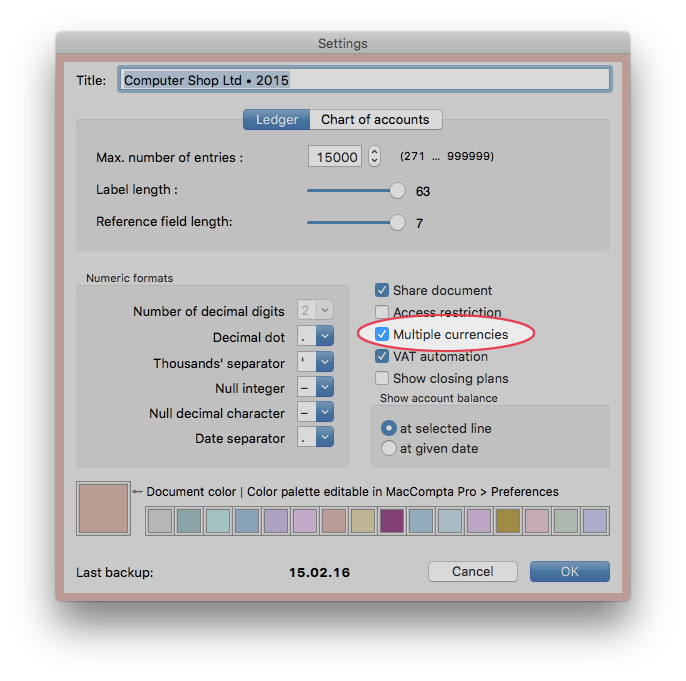

NOTE : In order to activate multiple currencies, check the “Multiple currencies” box in File > Settings.

This can be changed at any time.

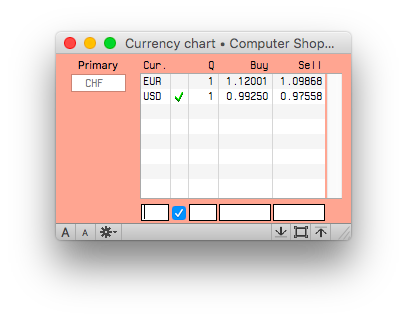

2 – Currency chart

You need to edit the currencies used in the currency chart too.

Cur: currency

Currency : the currency name must contain 1-4 alphanumeric characters. E.g. EUR, USD, GBP, etc.

Exch: √

When you enter a new currency, enable automatic foreign currency exchange by checking the box next to its name. You can also click directly in the chart in the column for the desired currency to check or uncheck that function.

Q : Quantity

Currency unit value based on which the exchange rate is calculated.

Buy, Sell

Buy and sell exchange rate (dictated by the bank !).

The currency chart can contain as many as 31 foreign currencies which can be added and corrected at any time. In the beginning, the chart is blank and only contains the main currency, which is, by default, represented by four blank spaces.

NOTE : The main currency is the only one which can be represented by four blank spaces. Moreover, if a currency is designated by four blank spaces in the chart of accounts, the software will interpret it as being the main currency, even if that currency is normally represented by a group of characters.

Therefore, since the main currency is represented by four blank spaces, only other currencies will become apparent in the ledger, thus standing in contrast.

If you ever need to change the name of a currency later on, go to Edit line > Special > Change currency name.

NOTE : Any foreign currency can be removed from the chart at anytime provided it is not attached to any account.

3 – Currencies and the chart of accounts

In order to use multiple foreign currencies, open as many Currency-position and Exchange accounts as there are currencies.

See chapter on the chart of accounts

NOTE : It may happen that the closing account is in a different currency. In this case, a warning message will be generated by the software.

In this case, the balance of the account expressed in foreign currency will be translated into the main currency at automatic closing provided that the currency in question is changeable and that the “Exchange” box in the ledger is checked.

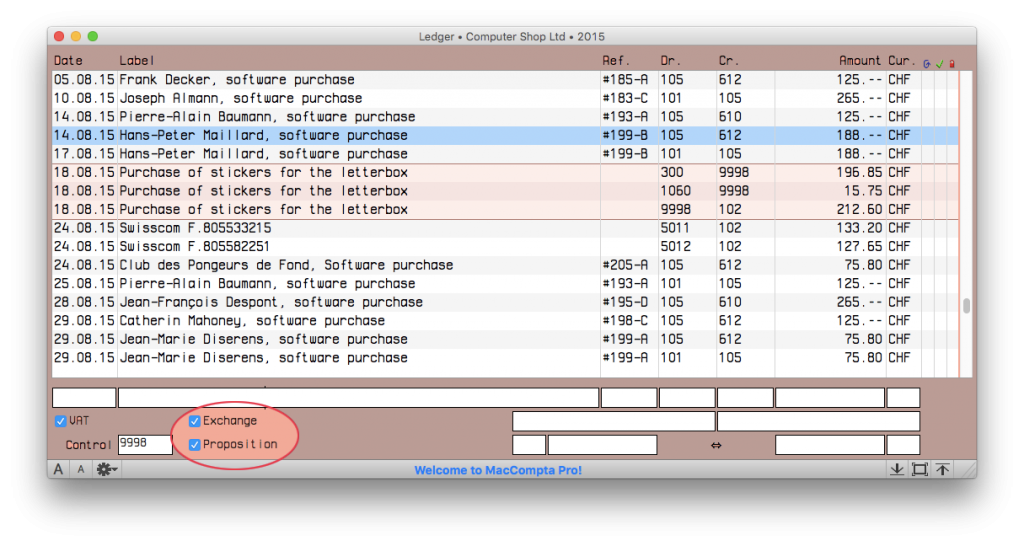

4 – Currencies and the ledger

In MacCompta, it is possible to record the rates of 31 foreign currencies at the same time, and to automatically generate multiple transactions when adding or inserting entries in the ledger concerned with accounts held in different currencies.

Exchange

Check this box to activate automatic exchange.

Restriction: The currencies of both accounts must be changeable which means the corresponding Exchange box in the currency chart must be checked. To do that, the Exchange rates for those currencies must previously have been entered.

NOTE : As a rule, the main currency is always changeable.

Proposition

Otherwise, and provided that the Proposition box is checked in the ledger, the software will generate corresponding transactions and you’ll just have to enter the amounts.

NOTE : This semi-automatic function (you just need to click on Proposition too) is particularly useful and necessary whenever you want to account for an operation affected by an exchange rate given on a bank slip, for example, with a rate which is very unlikely to be the one entered in the currency chart.

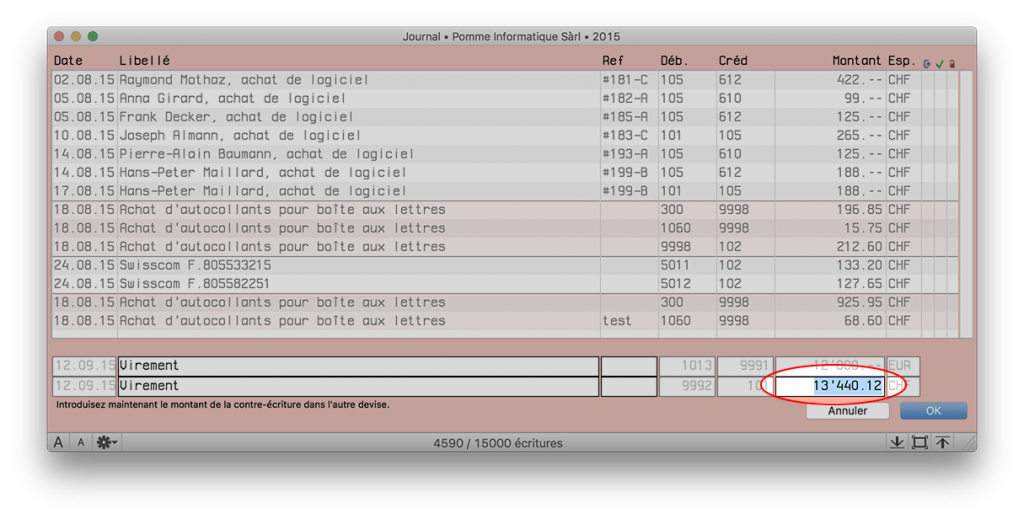

5 – Exchange between two foreign currencies

An exchange between two foreign currencies inevitably comes with a Proposition.

If the Exchange box is checked, the value of the Exchange counterbalance is calculated based on the currency used in the initial transaction.